About project

The Technology Metals Market is a unique platform that allows direct investment in technology metals and other high-tech materials, such as graphene and graphite.

These materials are crucial to industries such as electric vehicles, aerospace, semiconductors, and other advanced technologies and are in high demand, leading to global recognition of their critical importance.

Facts

The world's first commodity trading platform using blockchain technology

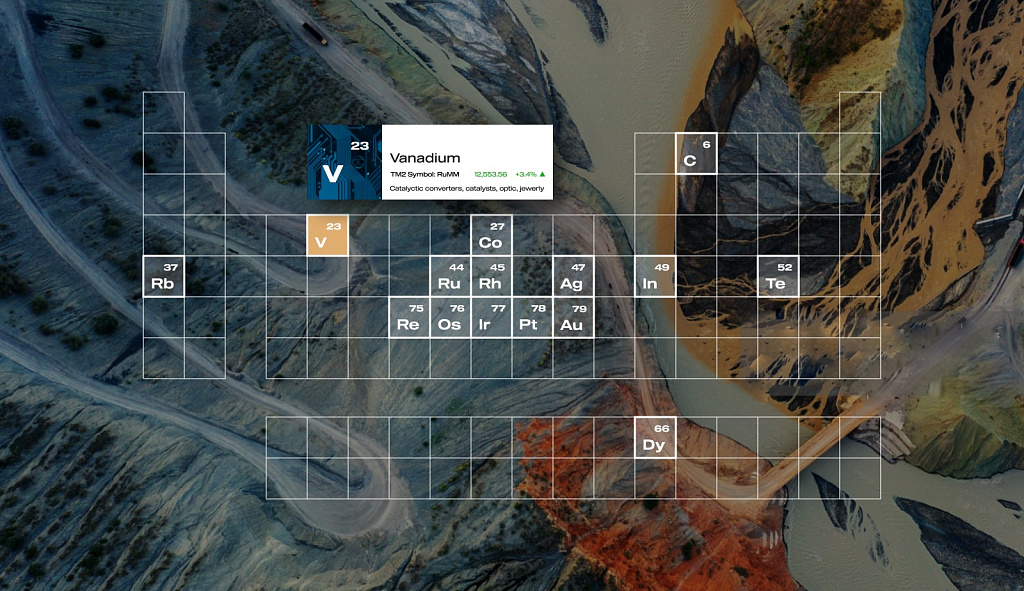

It offers trading in elements such as Ruthenium, Iridium, Dysprosium, Tellurium, and others.

It offers trading in elements such as Ruthenium, Iridium, Dysprosium, Tellurium, and others.

£20 M "Round A" funding with £100 M valuation

Current Round: Round A Working business.

Current Round: Round A Working business.

Analytics and reporting system for highly liquid trading Based on Microsoft Power BI.

The development team consists of 8 members:

3 Java/Kotlin/GoLang, 1 C++ blockchain, 3 front-end, 1 QA engineer.

3 Java/Kotlin/GoLang, 1 C++ blockchain, 3 front-end, 1 QA engineer.

The product management team consists of 3 members:

1 Product management, 1 UX/UI designer, 1 Analyst.

1 Product management, 1 UX/UI designer, 1 Analyst.

Customer

TM2 Limited

Spellsystems Role

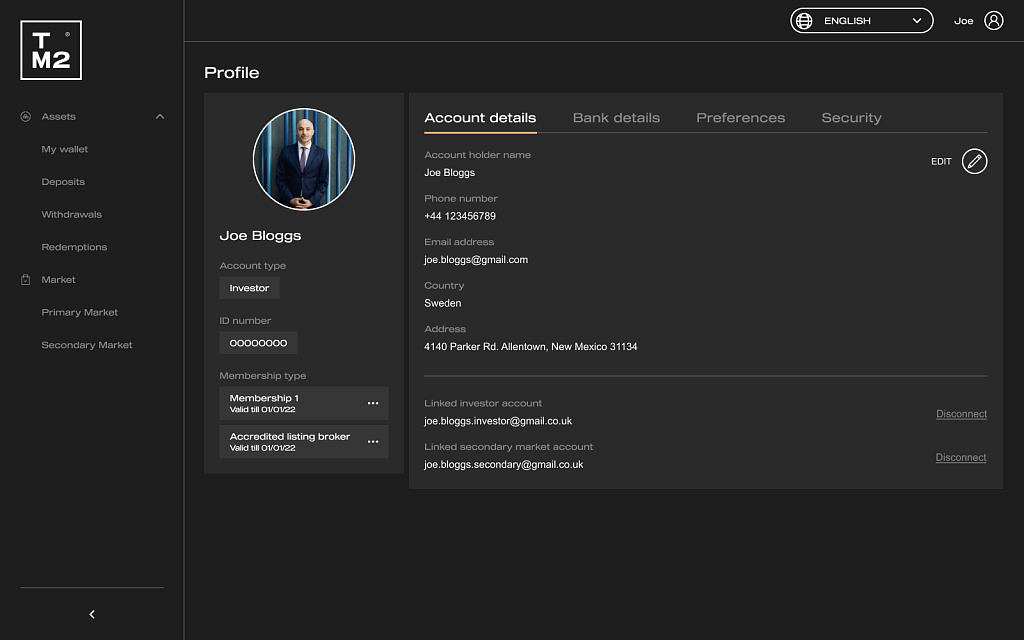

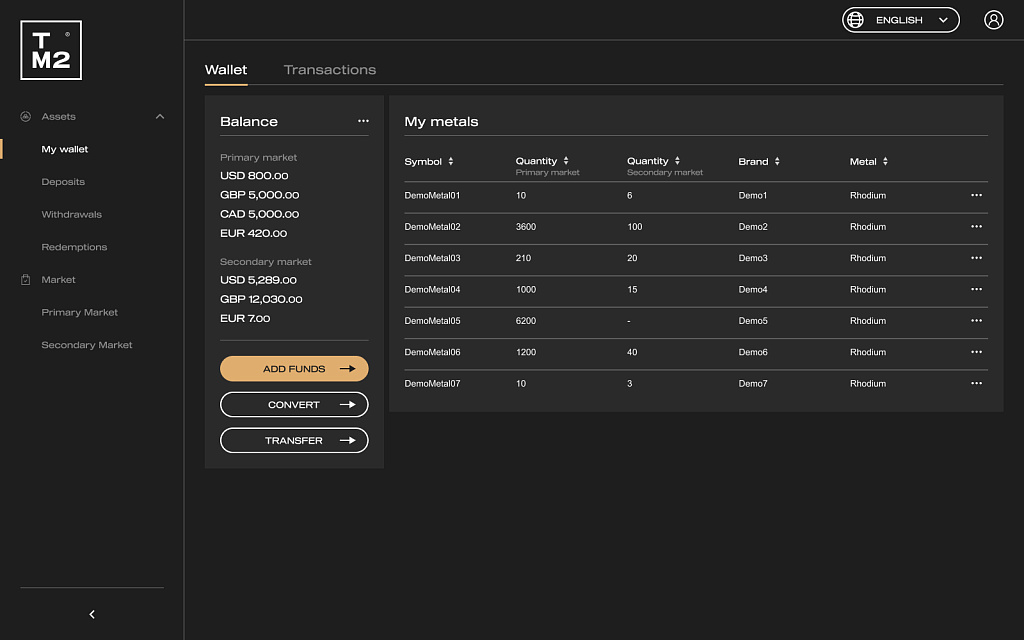

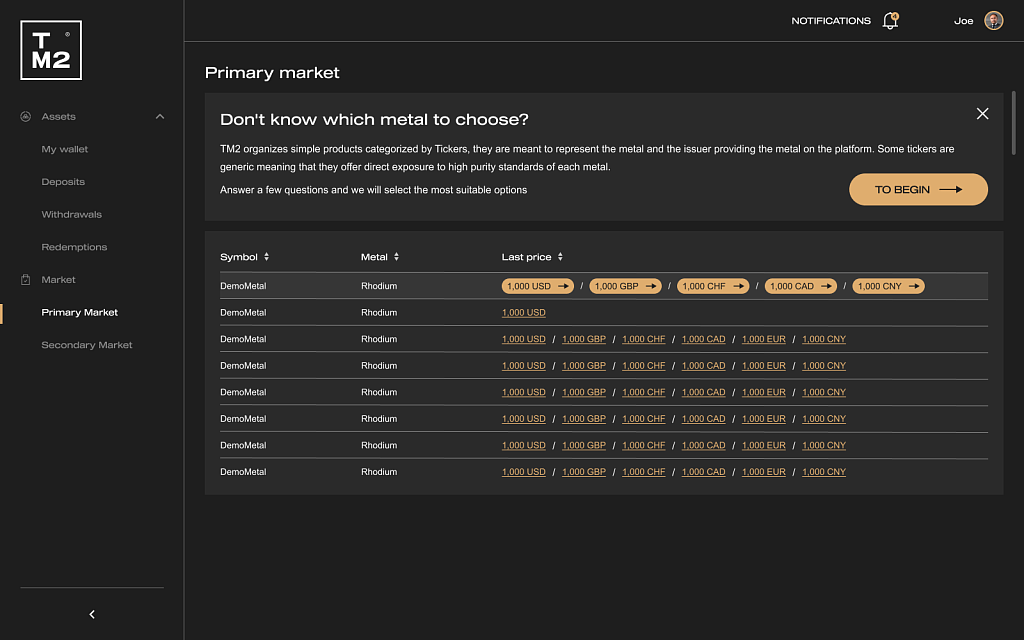

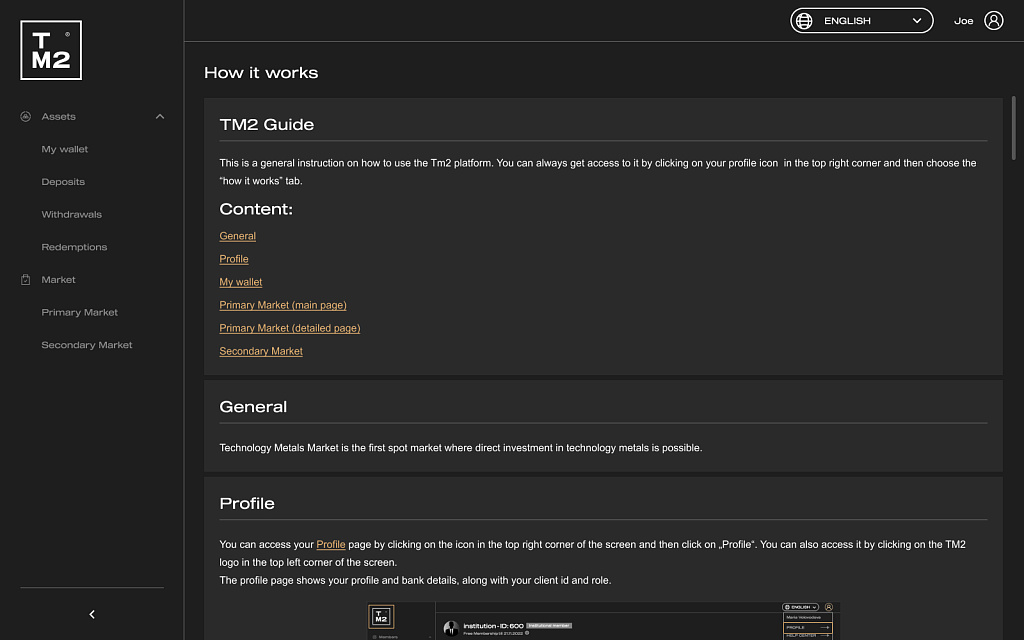

- Trading platform for the primary and the secondary market

- Integration of high-frequency matching engine for secondary market

- Integration of Trader Interface for high-frequency engine for secondary market

- Cash management system for multiple bank accounts settlements

- Development of the public website

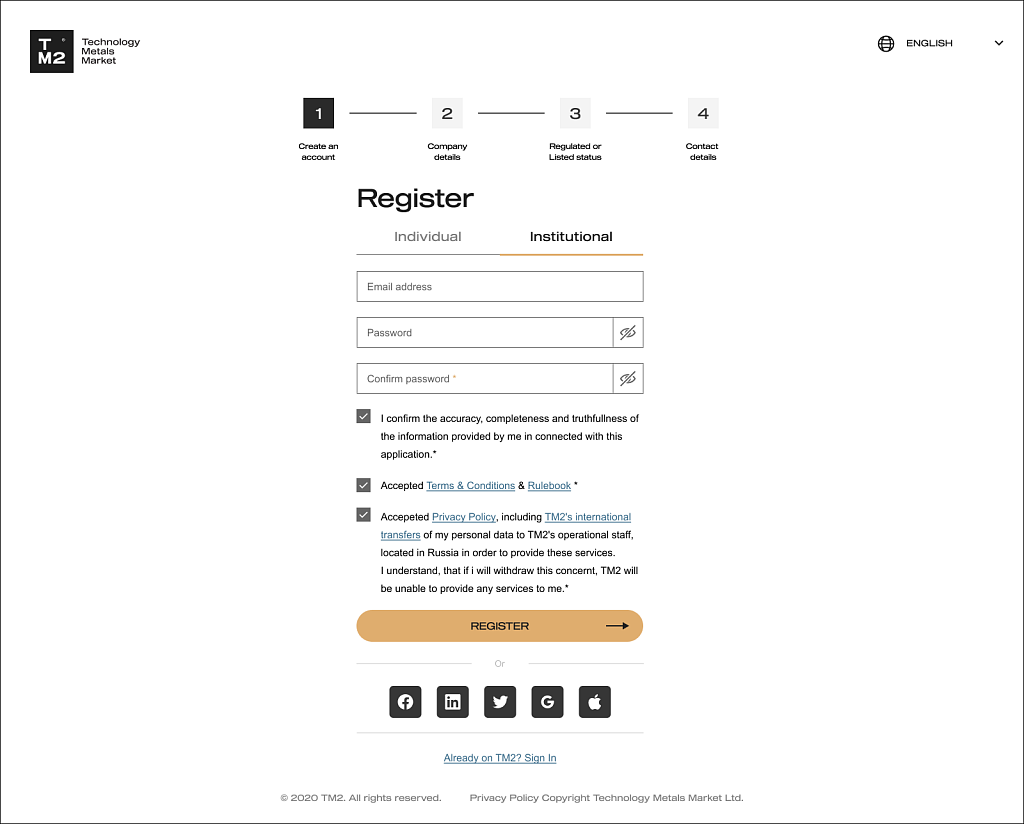

- Verification of client's identity

- Payment gateways

- Analytics and reporting based on Power BI

- Full clearing and settlement system

Implementation

We have developed a software product that integrates a lot of services that are critical to metal trading, including:

- High-frequency trading engine provided by NASDAQ

- UI interface trading, provided by CQG

- Analytics and reporting system, based on Power BI

- Compliance verification provider

- External bank systems

- Payment gateway

- Public blockchain

Technologies

Basic technologies

1

- C++

- Golang

- Java

- Kotlin

Web Interface

2

- React.js

Screenshots

Similar cases studies

Tokenized Uranium Product Family

U3O8 is the first token that is physically backed by uranium. It’s the world’s first attempt at democratizing global access to the uranium market with stablecoin backed by uranium or NFT assets that provide uranium-based products in metauniverse or with collaboration with other crypto assets.

Sportsbetting Dark Pool

Sportsbetting Dark Pool is an exchange platform for bookmakers, including betting shops, syndicates or hedge funds with cryptocurrency payments. The exchange algorithm works P2P, which assumes no single central counterparty on which all bets are kept. All bets are absolutely secure and anonymous, and even the company staff does not know who is betting on the game.